🎉 Claim your 3 Day FREE Trial and 33% Off Your First 3 Months with Dollarwise Today! Offer ends March 31st.

Launch Date has been Updated

dollarwise 6.0 is officially live!

Worth the Wait: Dollarwise now Launches on February 23rd at 10am CST

Rewrite Your Money Story with The All-New Dollarwise.

We hit some tech issues and refused to launch sub-par. We fixed them. Now you're getting the best version on day one; something actually worth the wait.

Rewriting your money story means changing the beliefs and habits that have held you back, so you can feel clearer, more confident, and in control of your next chapter.

Claim your 3 Day FREE Trial and 33% Off Your First 3 Months with Dollarwise Today!

Offer ends March 31st.

Rewrite Your Money Story with Dollarwise.

Rewriting your money story means changing the beliefs and habits that have held you back, so you can feel clearer, more confident, and in control of your next chapter.

Premium access to our personal finance community and the Budget Friendly Cookbook.

(Only available in the U.S.)

Features That Empower You

A smarter way to stay connected to your money

Dollarwise now works quietly in the background so you do not have to obsess over every dollar.

AI-Powered Insights

that surface patterns, risks, and opportunities automatically. No prompts. No digging. Just clear guidance when it matters.

Smart Goal Setting

Define your financial future with customizable goals from saving for vacation to building emergency funds.

Swipe to Review

Make consistent money review easy with our intuitive swipe feature. Quick weekly checks for peace of mind.

Real-Time Updates

See exactly where your money is going as it happens with instant transaction tracking.

Paycheck Planning

Align your budget with your pay dates to never be caught off guard financially.

Secure & Private

Bank-level security with Plaid integration. Your financial data is protected and private.

This is budgeting that stays flexible as your life changes.

Features that put you back in control

New Features designed to make money feel clearer and easier

We’re rolling out new tools that help you understand your money faster, stay oriented, and make better decisions without extra effort. These updates will launch gradually as we work toward our full release on February 23rd.

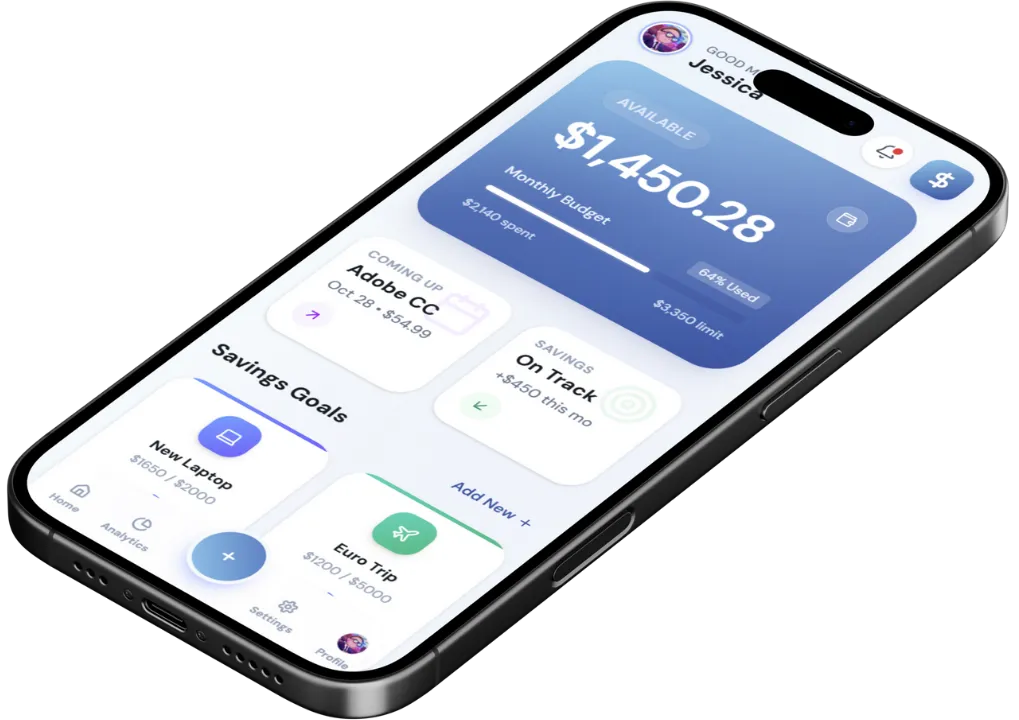

A Refreshed & redesigned experience

A bright, simple interface designed to feel calm and inviting the moment you open the app. Everything is built around clarity and confidence, so Dollarwise feels supportive instead of overwhelming.

Clean, full-picture transaction view

See exactly where your money is going in one clear place. The updated transaction view shows your spending clearly in one place, so you always know what’s happening without digging.

Review spending in seconds with a simple swipe

Swipe through transactions to confirm what purchases were for and spot patterns quickly. It’s an easy way to stay aware without turning money into homework.

Get helpful AI insights without extra work

AI powered insights surface patterns, progress, and next steps automatically, so you can focus on decisions instead of data.

Set goals that reflect real life

Create goals around what actually matters to you, whether that’s everyday balance, saving for something meaningful, or pulling back in a specific area. Your goals stay flexible as life changes.

Using Dollarwise? Get the latest updates.

New? Sign up and advance with us.

dollarwise exclusive

Claim your lifetime access

Missed out on the Founders VIP box? No problem, you can still get LIFETIME ACCESS to Dollarwise App PLUS the items below for my best price ever.

Available until Friday February 27th at Midnight

How Dollarwise Helps You Rewrite Your Money Story

Clear onboarding, flexible goals, and On-Demand reviews that keep your budget accurate and stress low.

We built DollarWise Budgeting for people who hate complicated finance tools. No endless menus. No guesswork. Just a clean, intuitive interface that makes budgeting feel effortless.

Step 1

Start with where you actually are

Answer a short set of questions to define what you want your money to do for you. Dollarwise uses this to shape your starting point so your plan reflects your real life, not a generic budget template.

Step 2

Set goals that make sense for you

Once a week, review recent transactions with a simple swipe and see how your spending lines up with your goals. Dollarwise keeps everything updated in real time and surfaces clear insights so you always know where you stand.

Step 3

Adjust as life changes

When paychecks shift, expenses pop up, or priorities change, your goals and plan adjust with you. No restarting. No redoing everything. Just steady progress that stays realistic over time.

What our users are saying:

We built DollarWise Budgeting for people who hate complicated finance tools. No endless menus. No guesswork. Just a clean, intuitive interface that makes budgeting feel effortless.

"I finally feel like I'm moving forward"

"Dollarwise is the first app that actually gets me. I finally feel like I'm moving forward, not just tracking backwards."

— Jordan, 34

"Dollarwise gave me clarity..."

"I make decent money but never knew where it went. Dollarwise gave me clarity without making me feel dumb."

— Maya, 38

"This app made it doable"

"As a single parent, budgeting always felt like one more heavy task. This app made it doable. Even hopeful."

— Chris, 42

Tried other apps and bounced? You’re not the problem.

Most tools expect you to know how to budget before you start. Dollarwise meets you with calm, clarity, and a plan that fits real life.

No lectures. No learning curves that leave you behind.

This is budgeting that respects your effort and supports your growth.

Simple, secure, and built for everyday use.

Real time spending updates so you always know where your money goes

Paycheck based planning that lines up with when you actually get paid

Automatic transaction sync through Plaid for up to date accuracy

Ad free experience designed to keep your focus on progress

Advanced insights that help you understand your bigger financial picture

Bank level encryption to keep your data protected

How Dollarwise Helps You Rewrite Your Money Story

You Don't Need to Be a Money Expert.

You Just Need a Better Starting Point.

Just calm, clear progress.

FAQ's

If I'm already paying for Dollarwise, do I have to pay extra for this update?

No. As an existing subscriber, you will always be able to use the latest version of the app for no additional charge.

Will Dollarwise be available outside of the United States?

No. While we’re excited to expand into new countries ASAP, Dollarwise 6.0 is still only compatible with financial institutions in the United States.

Does Dollarwise sell any of my personal or financial information?

No. Our subscription model allows us to remain a private venture, so we're not beholden to any shareholders or outside influence that wants to profit-at-all-costs from your data.

Why is this better than a Spreadsheet?

Dollarwise 6.0 is designed specifically to make budgeting simple. Smart insights, clean interfaces, and automatic spending updates remove the need for overwhelming spreadsheets.

Will it be available for Andorid/iOS/Web?

Dollarwise 6.0 goes live for Android and iOS on February 17th at 11 am CST. Stay tuned for the desktop version, planned to launch later this year.

How do I get the cookbook?

U.S. based Dollarwise Annual subscribers are eligible for the cookbook(offer ends March 31st). After subscribing fill out this form to submit your claim: https://get.dollarwise.com/claim-promo

Can I pay for Dollarwise using Klarna/Affirm/BNPL?

No.

COMPANY

CUSTOMER CARE

CUSTOMER CARE

NEWS

LEGAL

© Copyright 2026. Dollarwise. All Rights Reserved.

Here’s How Caleb Fixes Your Financial Mess…

Take Control of Your Personal Finances

Know your numbers, kill the guesswork, and stop overdrafting like it’s a hobby.

Build a Bulletproof Budget

One you’ll actually stick to (yes, really).

Avoid “Walmart Floor” Moments

Because passing out in public over money stress isn’t a good look.

Does This Sound Familiar?

You’re scared to check your bank account...

You're working your ass off but somehow always broke by the end of the month.

You want to save money, but budgeting makes you feel like you’re back in math class.

Your friends are posting about their "investments" and "emergency funds" while you're over here Googling "how to make $20 last until payday" at 2 AM.

You feel behind, ashamed, and honestly? A little pissed off nobody ever taught you this stuff.

School taught you all about Shakespeare but not how to avoid overdraft fees. While your parents are either secretive or STRESSED.

Here's the truth:

You're not failing because you're bad with money. You're failing because you were never given the tools to succeed.

The Proof Is In The Pudding

There's a reason why students keep coming back...

COMPANY

CUSTOMER CARE

CUSTOMER CARE

NEWS

LEGAL

© Copyright 2026. Dollarwise. All Rights Reserved.